The Best Strategy To Use For Wyhy

The Best Strategy To Use For Wyhy

Blog Article

Wyhy Things To Know Before You Get This

Table of ContentsThings about WyhyHow Wyhy can Save You Time, Stress, and Money.Wyhy Can Be Fun For AnyoneWyhy - TruthsThe 5-Minute Rule for WyhyThe Facts About Wyhy Revealed

Longer terms can reduce up the finance. It will be easy to return the financing, and you will have a longer time for it. You will need to pay lower monthly settlements for the boat car loan because credit offers longer terms for boat loans than regional banks, to ensure that monthly repayments will be lower.

A watercraft financing can be made use of to fund additional digital devices. It will certainly be helpful for you to buy brand-new items for the boats to make your time on the water very easy.

The Only Guide for Wyhy

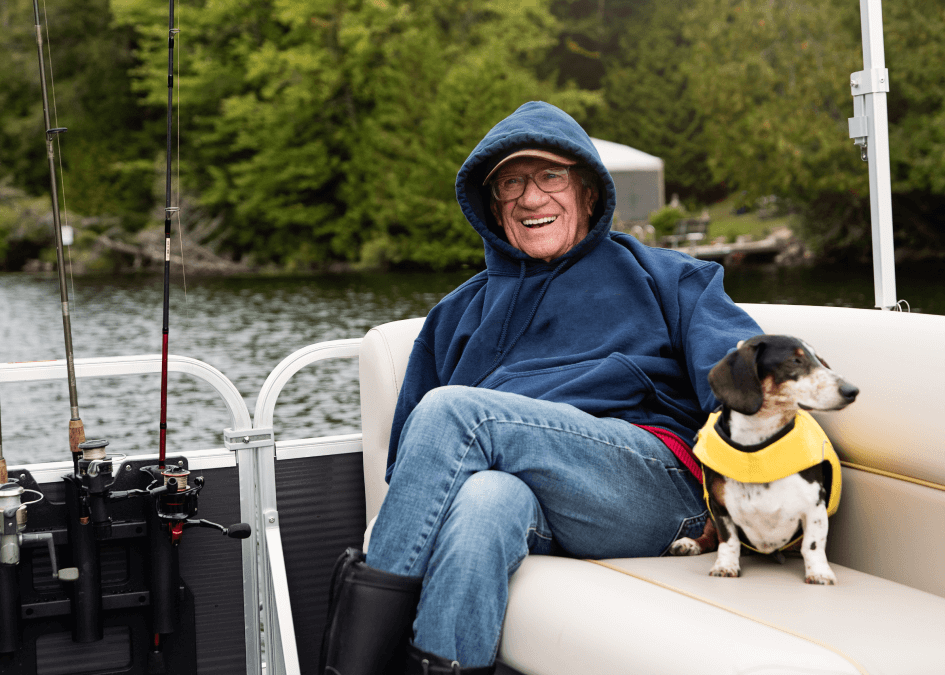

Although utilized watercraft lendings might sometimes have higher rates than brand-new boats, it is not always the case. Lots of lenders offer competitive rates no matter of whether you are getting new, used, or refinancing. Explore current rates and make use of a funding calculator to approximate your lending repayment. As the warmer weather condition approaches, that desire for riding the waves in your watercraft can be a reality.

"There are risks, or 'shoals' as we like to state, in boat funding, but that's where we excel, at navigating the ins and outs and uncovering any kind of surprise threats," said Rogan. "For instance, occasionally there is an issue with transfers in between previous proprietors, or we might need to do a title search with the Coastline Guard.

Wyhy Things To Know Before You Get This

"There are no techniques when it concerns getting accepted for a watercraft lending, but there are some approaches that we can use to ensure your monetary circumstance is stood for properly," kept in mind Rogan. "We've collaborated with most of the very same lenders for several years and understand what they are looking for and how to see to it that your details is offered in the very best possible light." The very best choice for a watercraft car loan is almost always a marine lending institution that concentrates on boat loans.

"Lenders who focus on watercraft lendings normally have a much better understanding of boats and their customers," stated Rogan. "For that reason, they can usually accelerate the approval procedure. https://padlet.com/johncole2312/my-funky-padlet-yvbyyhn5e7tab0jj. In some instances, the buyer can look for a funding in the early morning and be approved for the car loan the same day." Watercraft lendings utilized to be more limited in length and with larger down settlements; today, terms of 10 to two decades are quite typical (credit union cheyenne wyoming).

Recognize and value the precise boat you want. Determine and price the watercraft insurance coverage you need. Launch the acquisition. If it seems easy, well, her response that's because it is. Many new boats are bought with a financing, so reputable treatments remain in area. When it comes to who to secure the car loan from, you'll have three basic alternatives to pick from: This is usually the most effective wager.

Unknown Facts About Wyhy

They can generally aid with some referrals for establishing insurance coverage, as well. Some purchasers that have a great deal of equity in their home locate it helpful to obtain a home equity finance or a bank loan, either since they may get a reduced rate of interest or for tax obligation functions.

, made up of loan providers who are familiar with all the ins and outs of making watercraft car loans. When you obtain your boat financing, simply what will the repayments be?

Wyhy Things To Know Before You Get This

Credit report, debt ratios, and net worth may all be thought about by the loan provider, essentially depending on your personal situations and the dimension and regard to the car loan. However, there are a couple of generalities that are true for the huge bulk of boat fundings: Passion prices normally go down as the funding quantity increases.

Higher loan amounts can generally be extended over longer periods of time. In many cases, boat fundings range from four to two decades. Generally, the lender will be basing a boat loan on a 10- to 20-percent down-payment. That claimed, there are some no-money-down offers out there. Often, you can roll the costs of devices like electronic devices, trailers, and even prolonged service warranties into a watercraft lending.

The Wyhy Statements

Most loan providers will certainly be seeking credit report of concerning 700 or greater. You can get a boat lending with a reduced credit rating, but anticipate that you may need to pay a fine in the kind of a greater interest rate or a bigger down-payment. Be sure to read Funding & Watercraft Loans: Valuable Information for Boat Possession to read more regarding a few of the finer factors of funding a boat.

Securing a funding to purchase a boat is a whole lot like getting a finance to buy a cars and truck or a home. You can get a secured boat car loan that provides the boat as security or an unsecured funding that will certainly lug a greater rate of interest price and a lower line of credit.

Report this page